Honey Inspection and Label Requirements for Retail Markets in Mississippi

The responsibility for inspection of honey bottling facilities rests with the Mississippi Department of Health (MSDH) as authorized by a memorandum of understanding between that agency and the Mississippi Department of Agriculture and Commerce (MDAC), which has authority over most other laws related to beekeeping and honey. In 2019, MSDH announced changes to its policy governing inspections of honey processing facilities. The policy change brought the inspection procedures more in line with relatively new federal standards within the Food Safety Modernization Act (FSMA). The policy change helps small-scale beekeepers by eliminating the inspection of their honey bottling facilities if they meet certain requirements. Almost all of these small-scale beekeepers wanted to sell their honey at local restaurants, “mom and pop” grocery stores, and gas stations, and owners of those venues did not require the honey to have been processed at an inspected facility.

Most commercial beekeepers were not affected by this policy change. Their existing wholesale and retail honey markets already required the honey to be processed at an inspected facility because the monetary value of their annual honey production exceeded the threshold that triggers inspection by the U.S. Food and Drug Administration (FDA). Additionally, many large retail stores require that honey provided by a commercial beekeeper must be processed at a facility that has been inspected by MSDH. Similarly, many commercial beekeepers sell honey in 55-gallon drums to honey packers, and most packers require that the honey is processed at an inspected facility. The honey may also be subject to inspection for adulteration of the sugars and/or to quantify levels of agricultural chemicals (e.g., herbicides and insecticides) that might be present in honey.

MSDH Policy Change

In 2019, MSDH implemented a less-restrictive policy that relaxed the previous inspection standards to better fit the way honey is treated by FSMA. They elected to treat honey as a “raw agricultural commodity” (RAC), which exempted it from treatment as a cottage food industry product. This parallels FDA honey policies. A policy is easier to modify than existing law, but this also means it can change when agency leadership changes. This document describes the current policy, but it is subject to change at any time.

Language of the original laws governing fee assessments for honey inspections and licensing has not changed. Producers selling more than 500 gallons of honey per year must have their facilities inspected annually by MSDH. The portion of the Mississippi code addressing inspection and license fees is 41-3-18, and the most troubling portion of the code is the following phrase:

Persons who make infrequent casual sales of honey and who pack or sell less than five hundred (500) gallons of honey per year, and those persons shall not be inspected by the State Department of Health unless requested by the producer.

The words “infrequent casual sales” have been inconsistently interpreted. Neither the frequency of sales nor the meaning of “casual” is defined in the code, so both portions of the phrase are open to interpretation. Most small-scale beekeepers thought they fit the exemption because they did not sell more than 500 gallons of honey per year. However, MSDH could consider selling 25 bottles of honey per week at a local convenience store as a frequent sales schedule (and not casual), while the small-scale beekeeper would not agree. Beekeepers would argue that, although the frequency of honey sales could be 25 bottles per week, they would only sustain such an effort until they sold their total lot of tens to hundreds of bottles.

The key change in policy is that small-scale beekeepers can harvest their honey and bottle it to be sold on shelves of stores as a retail item without inspection by MSDH (if they produce less than 500 gallons). In the past, once a bottle of honey left the producer’s hands and was placed on a store shelf, it was considered a retail item that required license and inspection. This change is important for small-scale beekeepers who sell their honey at small, local stores; however, it is unlikely to change larger retail stores’ (e.g., Whole Foods) requirements that their suppliers be licensed and inspected by MSDH. Large retail stores can refuse suppliers whose facilities are not inspected by MSDH. Note that any beekeeper—large- or small-scale—may request an inspection by contacting MSDH.

Labeling Requirements

MSDH has mandated a warning phrase be included on honey labels for retail sales in Mississippi (Figure 1). If a beekeeper has labels that do not contain the warning phrase, they may purchase stickers with the warning phrase from beekeeping equipment suppliers. These stickers are usually small circles that will fit on the top of most honey jar lids. MSDH wants to warn consumers that spores from botulin-producing bacteria could be in some honey and that the immune systems of infants under 1 year of age may not protect them from infection. The bacteria can cause severe illness and even death in infants.

Figure 1. Every jar of honey sold on retail shelves in Mississippi must have an infant warning phrase printed on the front label or address label or on a sticker that can be placed on top of the lid. Most major beekeeping supply companies sell rolls of the warning stickers.

Mississippi code 75-29-601 dictates Mississippi’s requirements for honey labels, but some additional requirements originate from federal agencies. All honey produced and sold in Mississippi must include the address of the producer on the label (Figure 2). Some of our largest retail honey producers use a specific street mailing address or P.O. box with the company’s name on the label. Others simply put the company name, city, and zip code. MDAC will accept either. However, to remove any ambiguity, it is best to use a physical mailing address that matches your home address or bottling facility location. This practice makes it easy to find the producer if any product issues arise.

Figure 2. Example of a front label for a jar of honey showing the physical address for the beekeeper or producer and the content weight statement in English and metric units. The phone number is optional.

All honey labels need a content statement that accurately describes the amount of honey in the jar. In the past, this descriptor could be mass or weight (e.g., ounces, pounds, grams) and volume (e.g., fluid ounces). Because honey is sold mostly by weight, it makes more sense to report jar contents by weight. Additionally, the weight should be given in both English and metric units. For example, a 1-pound honey jar’s weight statement would be “16 oz (454 grams).” This measurement should appear on the lower third of the label.

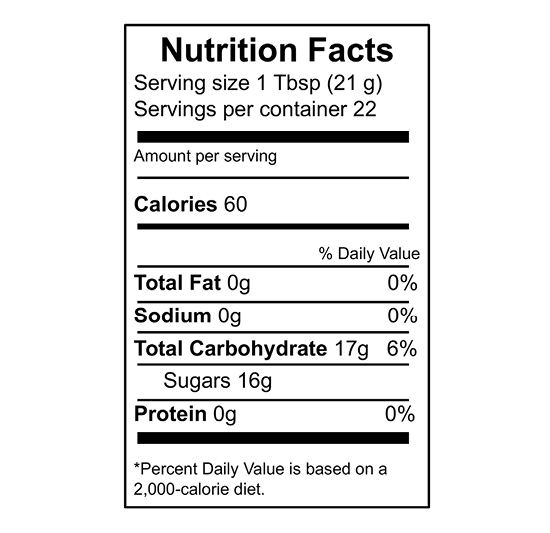

The FDA strongly suggests nutrition labels be added to commodities like honey and maple syrup (Figure 3). This is not currently a legal mandate. Some large retail stores may require the nutrition label before they accept your bottled honey.

Figure 3. Example of a nutrition label for a 1-pound (454 g) jar of honey. This label is typically placed on the back of the jar.

Definition of Honey (Mississippi Code 75-29-601)

In 2022, the laws governing honey labeling were updated and amended to reflect various trends in the types of honey-related products sold in retail markets. These updates gave clarity about how honey is defined and how to properly label products with added flavorings or spices (e.g., cinnamon added to honey). Section 1 of this code defines honey, describes what is considered adulteration of honey, outlines the proper way to list ingredients in value-added products made with honey, and eliminates so-called “lab-grown” honey as a legitimate product that could be sold as “honey.”

Here is the legal definition of honey as defined by the Mississippi code:

… “honey” shall mean the sweet, syrupy substance produced by honey bees from the nectar of plants (including honeydew) which the bees collect, transform, deposit, dehydrate and store, ripened and matured in the honeycombs. The consistency can be fluid, viscous, or partly to entirely crystallized. The flavor and aroma vary but are derived from the plant origin. “Honey” may not contain any additional food ingredients, including food additives.

There are some important points to emphasize:

- Honey is derived from natural sources of sugars—nectar and honeydew. If a colony of honey bees is fed gallons of sucrose syrup by a beekeeper, and the bees convert the syrup into stored food in their combs, this stored food could not legally be sold as honey because it is not derived from the natural sources as outlined in the code. If this practice were done purposely to deceive consumers, it would be a criminal adulteration of honey.

- If honey is combined with another sweetener, it can no longer be sold as honey. It is considered adulterated or artificial, and the label must list all ingredients in descending order of the proportions contained in the mixture. For example, if someone mixed honey with a smaller proportion of corn syrup, the label cannot bear only the word “honey.” The material would need to be labeled as a “blend of honey and corn syrup,” and the ingredients would be listed in order, with honey listed first, followed by corn syrup. If there is more corn syrup by proportion than honey, the ingredient list would be reversed, with corn syrup listed first, followed by honey. This second product would need to be labeled as a “blend of corn syrup and honey” to reflect the true nature of the product. Mixtures of honey with any other sweetener cannot be labeled solely as honey.

- Value-added honey products include flavored or infused honey. Typically, these products have honey as the major component and flavorings or spices as secondary ingredients (by proportion in the blend). Some examples are “raspberry-infused honey” or “cinnamon honey.” These cannot be sold with “honey” as the only descriptor word on the label. The ingredients must be listed in order of decreasing proportion in the mixture. Additionally, all ingredients must be listed in the same font size as the word honey.

- A new technology is being developed that allows the production of lab-grown honey. Essentially, a honey-like substance is produced in a laboratory without living honey bees. Instead, sugars are mixed with enzymes in laboratory glassware, and the mixtures are processed to produce something that can taste like honey. According to the Mississippi code, this unnatural product cannot legally be sold as honey. Honey is produced by free-flying honey bees that collect and transform nectar and/or honeydew into a natural food that is harvested by beekeepers.

The Mississippi code concludes:

It shall be unlawful for any individual, firm, organization or corporation to label and/or sell, offer for sale or expose for sale at the retail level of trade any product as “ honey” that does not meet the minimum requirements established by subsection (1) of this section and by the Mississippi Department of Agriculture and Commerce.

Summary

- The word honey can only be used for the sales of the food produced by honey bees that is derived from natural sources such as nectar or honeydew.

- The material harvested from honey bees that is obtained after feeding them sucrose syrup or high fructose corn syrup is not honey. Instead, it is an adulterated honey-like product that is illegal to sell as honey.

- Producers selling 500 or more gallons of honey annually must have their honey bottling facility inspected by the Mississippi Department of Health (MSDH) for compliance to cottage food industry standards.

- Producers selling fewer than 500 gallons of honey annually are not required to have their bottling facilities inspected. However, many large retailers will only sell honey that has been processed in facilities inspected by MSDH.

- If harvested honey is blended with other sweeteners, the retail product is considered adulterated or artificial, and it cannot be sold as honey. Instead, it must be sold as a “blend of component A and component B,” and the ingredients must be listed in order of highest proportion first.

- If harvested honey is blended with flavorings or spices, the value-added product cannot be sold as honey. Instead, it must be sold as a “flavor-infused honey” or “honey flavored with spice,” and the ingredients must be listed on the label in order of highest proportion first.

- All honey labels in retail stores must include:

- Physical mailing address of beekeeper’s home or bottling facility (or a P.O. box)

- Net weight statement in English and metric units

- A warning label about not feeding honey to infants younger than 1 year old

- Other label recommendations:

- A contact phone number for quickest response to potential issues with the honey

- A nutritional label on the back of the jar

References

The Mississippi Secretary of State’s Office maintains a link to the Mississippi Code of 1972: http://www.lexisnexis.com/hottopics/mscode/.

All portions of the code can be downloaded as PDF files. Table 1 lists where in the code to find the various sections related to honey. Items are organized by title, chapter, specific code line, and sometimes article.

As an example, MS Code 75-29-601 designates labeling requirements for honey. The code reference begins with Title 75, which is “Regulation of Trade, Commerce, and Investments (Chapters 1–95).” Chapter 29 is “Sale and Inspection of Food and Drugs (Articles 1–21).” The article is not listed in the code shown here; however, Article 13 covers “Honey and Products,” and it consists of code lines 601–607.

Table 1. Mississippi Code designations related to honey.

|

Title |

Chapter |

Article |

Code Line |

Description |

|

41 |

3 |

In General |

18 |

Permit for fee assessment |

|

75 |

29 |

Article 1 |

19 |

Enforcement charge |

|

75 |

29 |

Article 1 |

21 |

Analysis of samples |

|

75 |

29 |

Article 13 |

601 |

Labeling requirements |

|

75 |

29 |

Article 13 |

603 |

Enforcement |

|

75 |

29 |

Article 13 |

604 |

Hearings, process, appeals, etc. |

|

75 |

29 |

Article 13 |

605 |

Criminal penalties |

|

75 |

29 |

Article 13 |

607 |

Records of names of manufacturers |

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 3953 (POD-11-23)

By Jeffrey W. Harris, PhD, Associate Extension/Research Professor, Biochemistry, Molecular Biology, Entomology, and Plant Pathology.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.