Oil and Gas Exploration in Mississippi: Tips for Landowners

Cautionary note: A lease is a legal document and should be reviewed by an attorney or other professional who is experienced with oil and gas leases. Leasing provides you with revenues, but you should also make sure that your interests and property are protected.

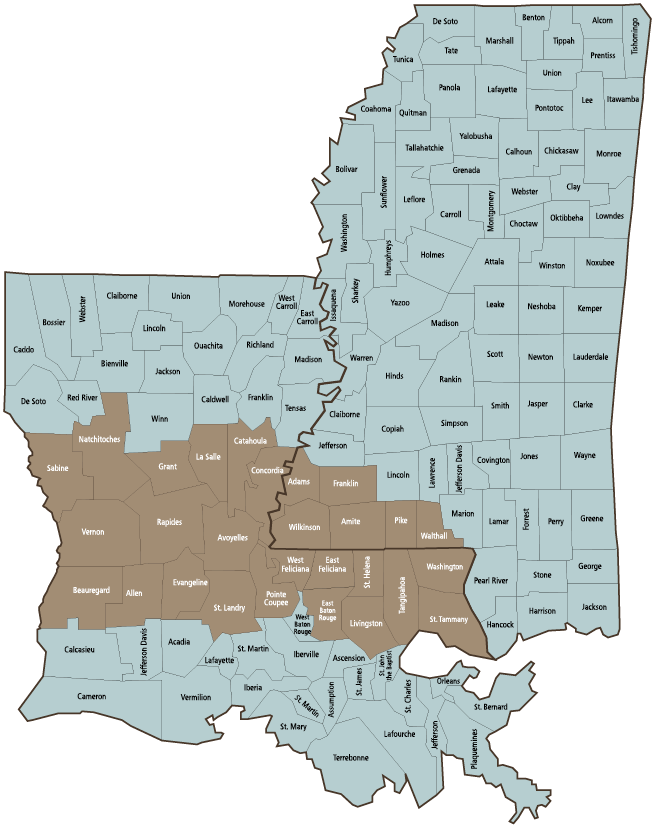

The Tuscaloosa Marine Shale (TMS) is a sedimentary rock formation that stretches across Louisiana into the southwest corner of Mississippi. In recent decades, shale formations have been shown to be rich sources of oil and natural gas, such as the Marcellus Shale in the Northeast U.S. and the Eagle Ford Shale in Texas. In Mississippi, oil and gas exploration is primarily focused on Adams, Amite, Franklin, Pike, Walthall, and Wilkinson counties, which are located in the TMS.

The TMS is also referred to as a “shale play.” Shale simply refers to the rock formation that contains the petroleum. A “petroleum play” or just a “play” is a term for a group of petroleum deposits in the same region and with the same geological characteristics.

The TMS is an unconventional oil reservoir, meaning that the oil and natural gas present in the formation are tightly trapped in the source rock. For this reason, the TMS has the potential to become a major source of oil and gas, but it presents difficult geological challenges requiring advanced drilling technologies, such as horizontal drilling or hydraulic fracturing, for extraction. These challenges are further complicated by fluctuating energy prices. Although these challenges have slowed the TMS’s development, companies in the energy industry have nevertheless approached Mississippi landowners about leasing their mineral rights.

This publication briefly discusses some important factors that private landowners should consider in making decisions regarding oil and gas leases. The subject is broad and complex, and our purpose here is to focus only on some important considerations. You should discuss all issues with the relevant professionals, such as your forester, wildlife biologist, accountant, financial and tax advisors, legal counsel, and real estate appraiser before entering a lease agreement.

Ownership

You should determine mineral ownership through a title search because you may or may not own the subsurface minerals under your land. Types of ownership include:

- Fee simple, which is absolute ownership of all surface minerals (including timber) and all subsurface minerals (oil and gas).

- Surface rights ownership, which includes only assets on the surface of the land.

In the latter case, the subsurface mineral rights were severed and sold off at some time in the past. Oil and gas, or other minerals, can be severed separately.

The Lease

Generally speaking, a lease is executed between a lessor, or the party who owns the property to be leased, and a lessee, or the party who leases the property. In this case, you, as the landowner, would be the lessor, and the oil or gas company would be the lessee.

The lease is composed of two terms. The primary term is the number of years in your lease and is negotiable, but usually lasts up to 5 years before drilling. The secondary term automatically starts with the commencement of drilling and lasts as long as there is production.

If possible, you should avoid automatic renewal of the primary term or renewal at the option of the lessee (the oil or gas company), which gives competitive control to the lessee. Instead, if the lessee is given the right of first refusal, they can still maintain control of exploration rights, provided they are willing to match a competitor’s offer for renewing the lease at the end of the primary term, which helps in establishing a market price. Such nuances are why the assistance and guidance of professionals in oil and gas leasing are so important.

Primary Types of Income

Bonus Payment

A one-time payment for signing a lease to allow exploration and drilling on your land. Payment is usually made within 60 to 90 days of signing. You should clearly identify in the lease agreement when the payment will be received, events possibly affecting payment, and the consequences of late payment. As with all payments, landowners should negotiate the rates for bonus payments, which are usually made on a per-acre basis.

Delay Rental Payment

These are payments made to the lessor to maintain the validity of the lease in the absence of drilling and production. They can be made to extend the period of the lease, and/or they can be made in advance, as part of the bonus payment

Royalty Payment

When the lessee strikes oil or gas, royalty payments are a portion of the value of the extracted mineral. The percentage can be determined from a comparison with local market prices.

It is important to remember that energy prices can fluctuate and that production changes over time. Both of these factors can cause changes in royalty payments. Production is usually higher when the well first comes online than in the latter stages of extraction. Thus, the first several royalty checks may be larger than those received in the long term.

In addition, because multiple tracts of land can be included in a drilling unit, known as “pooling” or “unitization,” royalties are prorated based on the number of acres of land in the unit owned by the lessor.

Finally, a shut-in royalty payment is paid when fully developed wells are not producing, due to a lack of pipeline infrastructure or the lack of a suitable market, for example. The reasons a well can be shut-in should be defined within the terms of the lease.

Additional Types of Income

In some cases, the landowner can negotiate free natural gas as part of their payment, although transporting gas from the wellhead to a house is unlikely to be included in the agreement. The landowner can also receive compensation for allowing the company right-of-way access to run pipeline to another property.

Income from gas storage rights should be negotiated separately from any other income streams, as should well-siting fees for pooling oil and gas from surrounding properties into a unit.

Finally, any energy development that involves harvesting other resources from the property should include selling those resources at fair market value. In the case of a timber sale (to access a site or develop a wellhead, for example), a forester should be consulted, and the subsurface mineral activities should be built into your forest management plan.

Potential Expenses

Expenses, including legal fees and property tax increases, should be factored into payment negotiations. In cases of property and environmental damages, compensation may reflect economic but not intrinsic value.

Insurance or your own financial reserve can help protect you if you feel your lease does not provide sufficient protection. An indemnification clause should be added to the lease to protect you against liability to third parties (e.g., loss, damage, or injury as a result of drilling on your property). You need to make sure that you are protected against, for example, the contamination of your, your neighbor’s, or your community’s water supply. The indemnification clause should include a duty to defend yourself so that the lessee pays litigation fees.

Tax Planning

All income streams from oil and gas drilling are considered ordinary income and are subject to federal and state taxation. Basis, or the investment value of the property, will be adjusted annually as oil and/or gas are depleted from the property.

A tax advisor will help you to determine which type of depletion is available to you and how it will affect your taxes. The advisor will also work with you regarding any conservation programs in which you are enrolled and which may affect your taxes.

Finally, an estate planner will help you to plan for the transfer of your property, including any mineral income streams, following your death. This will save your heirs time and money when it comes to estate taxes.

Questions to Ask Professionals

Because of the complexity of dealing with oil and gas leases, you should seek the advice and assistance of professionals who have knowledge and experience related to petroleum exploration and development. When determining which professionals to consult, be sure to ask questions like these:

- How long have you been in practice?

- How much experience do you have working on natural gas and oil issues?

- What are your qualifications? Tell me about your professional credentials, certifications, and how you stay updated or remain current in your field.

- Will you provide a written contract that outlines the service agreement and fees?

- How long will the work take?

- Will any of your work be delegated to others and, if so, how much?

- How do you charge or get paid?

Conclusions

Energy development provides a number of opportunities and risks for private landowners. As with any natural resource development, you should be prepared to carefully consider the financial, legal, and environmental implications of your decision to enter the energy production sector.

Landowners should understand that an oil and/or natural gas lease is the product of negotiation with the drilling company. Just as when buying a new car, you should do your homework, consult with professionals, and be skeptical of offers that “look too good to be true.”

Resources

The Mississippi State University Extension Service (http://extension.msstate.edu/) provides information and assistance on a wide variety of natural resource and agriculture topics, as well as economic development and household finances.

The Mississippi Department of Agriculture and Commerce (https://www.mdac.ms.gov) provides market information, publications, and resources related to agriculture.

The Mississippi Development Authority (https://www.mississippi.org) provides information, data, and news about economic development.

The Department of Environmental Quality (https://www.deq.state.ms.us) provides information about air and water quality issues.

The Mississippi Oil and Gas Board (https://www.ogb.state.ms.us) provides information and contacts regarding energy exploration and extraction.

The Mississippi Forestry Commission (https://www.mfc.ms.gov) provides information and landowner programs about forest resources.

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 3056 (POD-04-23)

By Jason S. Gordon, PhD, Associate Extension Professor, Forestry, and Rachael Carter, PhD, Extension Associate, Center for Government and Community Development.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.